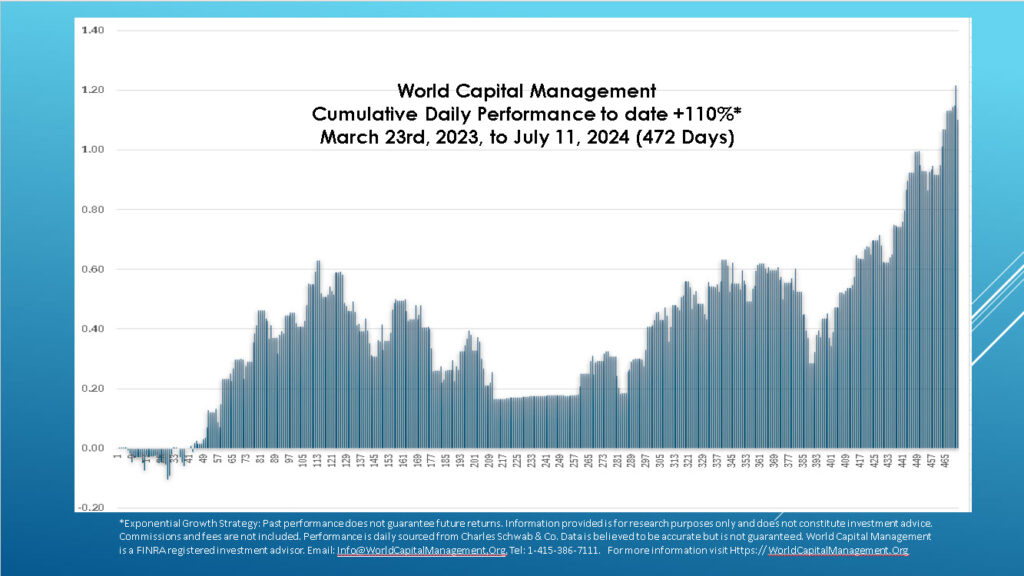

WCM’s Leveraged ETF Index Performances

WCM’s Actively invested Expodential Growth Performance

Period March 28, 2023, to July 11, 2024

Past Performance does not guarantee future returns.

Performance Disclosure

The performance data presented is based on the actual results of our master account at Charles Schwab. All Accounts under our management trade, similarly, following the long-term signals we have previously outlined.

Our investment strategy primarily involves timing investments in the ProShares Ultra Pro QQQ(TQQQ), with our historical market presence being about 50% of the time. On average, we maintain our holdings for approximately 6 months, which means we are typically out of the market for the other half of the year. Annually, we execute an average of one buy and sell trade. During periods when we are not invested in the market, we allocate our funds to 2-year treasury bills.

Additionally, the performance figures include contributions from a small number of shares in the MIcroSectors FANG+ Index 3X Leveraged ETN (FNGU), originating from a legacy account. As of March 15, 2024, accounts’ holdings in FNGU represent 1.93% of the total portfolio.

Commissions and fees are not included. For information on commissions and fees see https://worldcapitalmanagement.org/our-fees?

For historical back testing for all our models including the visit