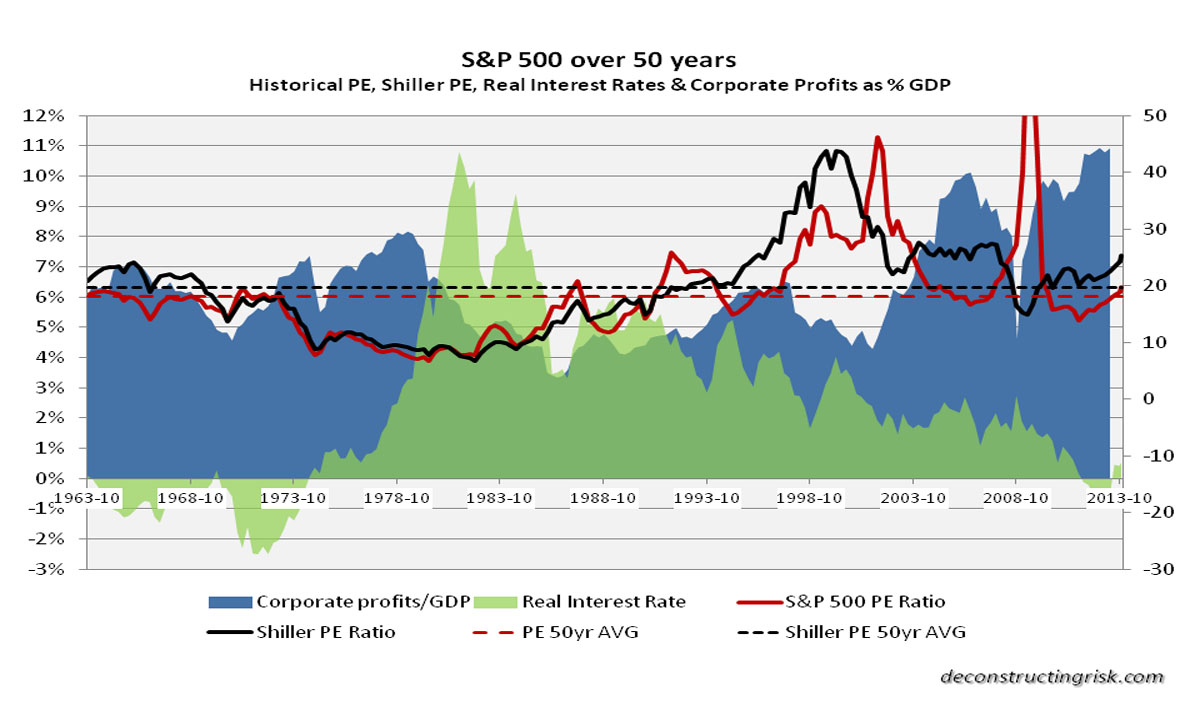

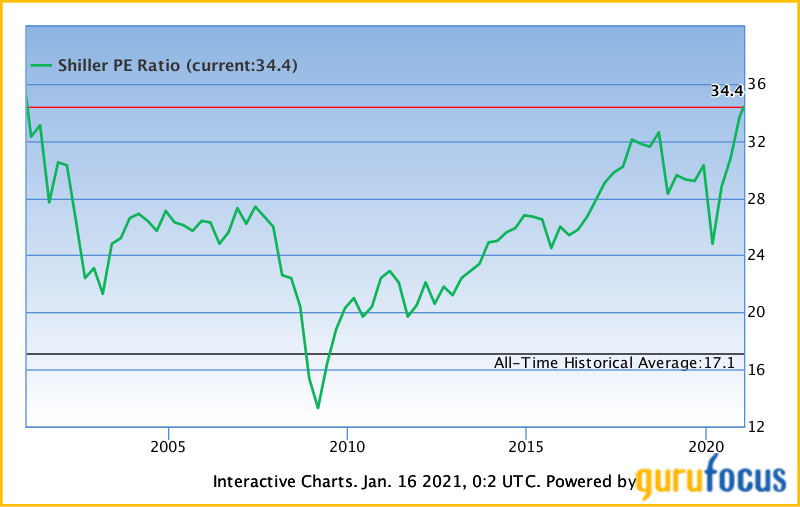

S&P 500 P/E Ratio – Current & Historic

The price-earnings ratio, also known as the P/E ratio, P/E, or PER, is the ratio of a company’s share (stock) price to the company’s earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. This link gives you both a short-term and long-term perspective on […]

S&P 500 P/E Ratio – Current & Historic Read More »